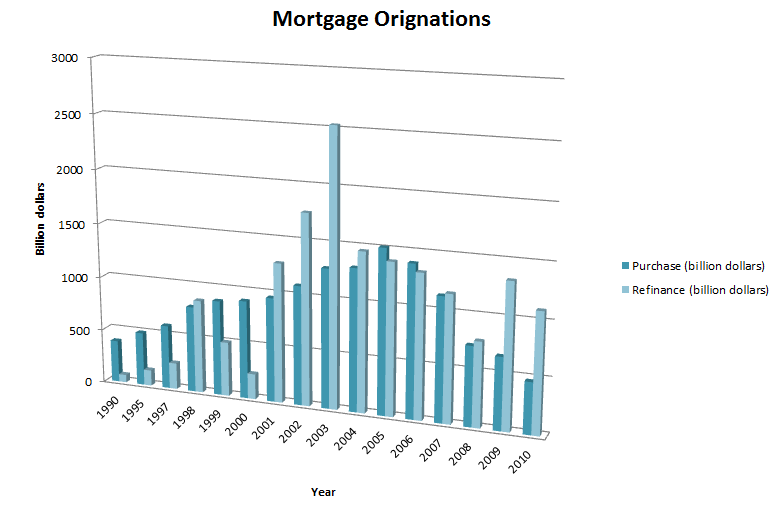

Mortgage Originations and Delinquency and Foreclosure Rates: 1990 to 2010

Source: census.gov

Covers one- to four-family residential nonfarm mortgage loans. Mortgage origination is the making of a new mortgage, including all steps taken by a lender to attract and qualify a borrower, process the mortgage loan, and place it on the lender’s books. Based on the National Delinquency Survey which covers 45 million loans on one- to four-unit properties, representing between 80 to 85 percent of all ‘first-lien’ residential mortgage loans outstanding. Loans surveyed were reported by approximately 120 lenders, including mortgage bankers, commercial banks, and thrifts.

According to Forbes, slowing mortgage revenues have dragged down top-line figures for the country’s biggest banks for a while now, with origination volumes declining quarter-on-quarter since the mortgage refinancing wave died down in late 2012.

The U.S. mortgage industry saw a notable reduction in mortgage origination volumes for the last quarter of 2014, with data compiled by the Mortgage Bankers Association showing that $278 billion in mortgages were originated over the period. This compares to origination figures of around $300 billion for each of the two previous quarters and $326 billion for the year-ago period.

The Mortgage Bankers Association is forecasting a 7% increase in mortgage originations in 2015, to $1.19 trillion, with purchase originations rising 15% to $731 billion in 2015, and refinance originations decreasing 3% to $457 billion.